Asset managers, frightened that the end-of-year rally on expectations of a tender touchdown was overly optimistic, are promoting bonds and boosting their money holdings.

Article content material

(Bloomberg) — Asset managers, frightened that the end-of-year rally on expectations of a tender touchdown was overly optimistic, are promoting bonds and boosting their money holdings.

Bond allocations amongst fund overseers have tumbled 17 proportion factors for the reason that identical time final month, in response to a Financial institution of America Corp. fund supervisor survey printed this week. The amount of cash they parked in cash market funds and different money autos rose 13 proportion factors in the identical interval.

Commercial 2

Article content material

Article content material

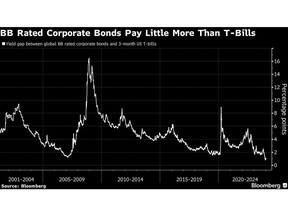

Taking earnings in bonds is sensible now. As a result of short-term charges are so excessive relative to intermediate- and longer-term yields, a junk bond doesn’t pay that rather more yield than a Treasury invoice. And financial officers warning that markets have grown too assured that fee cuts are coming quickly. Merchants are broadly tempering bets on the variety of rate of interest cuts by central banks this yr.

“This can be a month to promote danger right into a rally moderately than aggressively chase danger,” mentioned Adam Darling, a high-yield bond fund supervisor at Jupiter Fund Administration Plc, who’s amongst these growing his allocation to money. “If information signifies something aside from a tender touchdown there will likely be quite a lot of panic available in the market.”

For managers like Darling, it’s turning into tougher to justify holding bonds that may stoop if charges fail to fall as a lot as anticipated or if fears of a recession begin to intensify. Geopolitical tensions, together with assaults by Houthi militants on industrial vessels within the Purple Sea, might trigger inflation to begin to tick again up once more, complicating the outlook for financial easing.

Article content material

Commercial 3

Article content material

Click on right here to hearken to a podcast on the expansion of personal credit score

Charges merchants are presently pricing in additional than 5 25-basis-point cuts this yr within the euro area and the US, and greater than 4 by the Financial institution of England, in response to information compiled by Bloomberg.

Easing is probably going in the summertime, European Central Financial institution President Christine Lagarde mentioned this week, whereas cautioning that the aggressive bets are “not serving to our struggle in opposition to inflation.”

Allspring International Investments is among the many cash managers that also see a possibility in bonds as a result of yields are excessive sufficient to compensate for inflation, mentioned Henrietta Pacquement, head of worldwide mounted revenue and sustainability on the agency. However there might nonetheless be stress on the debt this yr, she mentioned.

“We’d be amazed if we didn’t have not less than one unfold selloff this yr,” mentioned Jupiter’s Darling. “The financial setting is so risky that we might have a selloff on even a small piece of unhealthy information.”

Click on right here to observe the newest version of Bloomberg Actual Yield

Week in Evaluate

- UBS Group AG has moved away from Credit score Suisse’s authentic plan to promote its $250 million distressed-debt enterprise to a single bidder after it failed to draw sufficient curiosity, and is as an alternative planning to eliminate the property individually.

- Buying and selling quantity for US blue-chip company bonds hit a report final yr, and will develop once more in 2024, as buyers have regarded to grab up notes whereas yields are nonetheless comparatively excessive and provide of recent bonds hasn’t been in a position to hold tempo.

- International leveraged mortgage gross sales are booming as issuers reap the benefits of robust purchaser demand forward of any cuts to rates of interest and election-fueled volatility later this yr.

- Corporations are dashing to borrow cash within the US high-grade and junk bond markets, with blue-chip debt gross sales approaching the best for a January since 2017, as companies look to reap the benefits of current drops in yields.

- Demand for Europe’s debt gross sales is operating at a report tempo as buyers clamor to lock in engaging yields earlier than central banks begin chopping charges.

- Till not too long ago, actual property was the poster youngster of what can go improper when rates of interest rise quickly. However now, bond costs are leaping and funding banks together with Goldman Sachs Group Inc. are endorsing the embattled sector.

- The worldwide speculative-grade default fee rose to the best stage since Might 2021, on the again of upper funding prices, inflation and tighter financing situations, in response to a Moody’s Buyers Service notice.

- Borrowing prices in China’s yuan bond market utilized by lower-rated companies and native authorities financing autos have dropped to the bottom in nearly twenty years, following a string of presidency measures to wash up unhealthy money owed and enhance the financial system.

- Main Chinese language lender Ping An Financial institution Co. has put 41 builders on a listing of builders eligible for its funding assist, a shift towards extra lending to a property sector in disaster following authorities steps to stanch the ache.

- JPMorgan Chase & Co. is in talks to clinch $2.5 billion to $3 billion of third-party commitments to develop its non-public credit score technique.

- Royal Financial institution of Canada reopened the loonie-denominated marketplace for debt just like the notes issued by Credit score Suisse Group AG that had been worn out final yr.

- Dish Community Corp.’s debt change ambitions are inflicting consternation amongst merchants who purchased a type of insurance coverage that pays out if the struggling satellite tv for pc tv firm defaults.

Commercial 4

Article content material

On the Transfer

- 5 Credit score Suisse portfolio managers are leaving the financial institution to arrange a brand new world macro fund on the options platform of Lombard Odier Funding Managers.

- Kevin Burke, a longtime banking govt who was an early determine within the leveraged mortgage enterprise, has died after a battle with pancreatic most cancers.

- Paul Gibbs, Citigroup Inc.’s present co-head of EMEA loans and leveraged finance, is ready be given a much bigger function that can embrace debt capital markets for the area.

- Carlyle Group Inc. has appointed Peter Mackie to world head of credit score distribution, changing Andrew Curry, who’s leaving the agency.

- David Hirschmann and Ariadna Stefanescu had been appointed co-heads of Permira Credit score, after former head James Greenwood stepped down from the enterprise in 2023.

- StoneX Group Inc. is searching for to develop its distressed gross sales and buying and selling enterprise at a time when bigger companies are exiting the market.

—With help from Dan Wilchins.

Article content material