Article content material

Pickering, Ontario, Jan. 05, 2024 (GLOBE NEWSWIRE) — Ayurcann Holdings Corp. (CSE: AYUR, OTCQB: AYURF, FSE: 3ZQ0) (“Ayurcann” or the “Firm”), a number one Canadian hashish extraction firm specializing within the processing and co-manufacturing of pharma grade hashish and hemp to provide numerous spinoff hashish 2.0 and three.0 merchandise within the medical and leisure market, is please to announce the next company updates.

Company Replace

Article content material

With the expansion of the hashish market and new merchandise choices into the market, Ayurcann is increasing its core inventory maintaining models (“SKUs”) listings within the vape, pre-roll, milled flower and focus classes, with 20 new SKUs anticipated in Ontario and Newfoundland over the subsequent 6 months. By increasing our model portfolio and model recognition, we plan to additional achieve market share to solidify our place within the Canadian leisure hashish market. Our merchandise are at the moment accessible in Ontario, British Columbia and Alberta.

Commercial 2

Article content material

Persevering with to construct strategic relationships and partnerships by means of fiscal 2024, Ayurcann stays dedicated and targeted on exploring new alternatives in Nova Scotia and Quebec, in addition to enhancing the expansion and market share of our present listings throughout Canada. Ayurcann merchandise beneath its ‘FUEGO’, ‘XPLOR’ and ‘H&S’ manufacturers have been properly obtained throughout the provinces with new flavours, innovation and worth contributing to their development, publicity and gross sales. With a concentrate on the quickest rising class of infused pre-roll, Ayurcann has launched 6 new SKUs for its flavour ahead vapes.

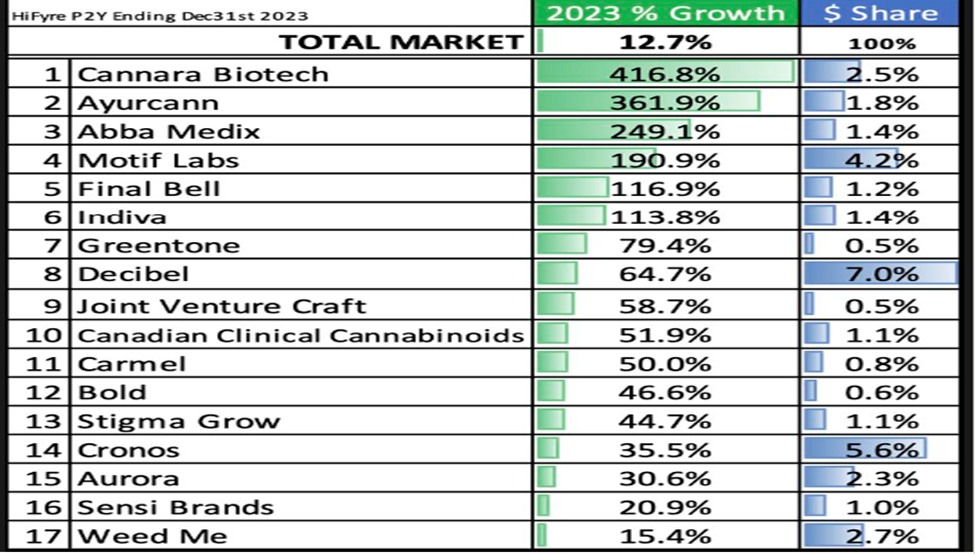

The next chart, primarily based on reporting by Hyfyre IQ™ as of December 31, 2023, denotes the Firm’s, alongside different corporations’ development, over the previous 12 months (minimal of three provinces of gross sales):

Choice and RSU Grants

The Firm can also be happy to announce the grant of inventory choices (every, an “Choice”) and restricted share models (every, an “RSU”) pursuant to the Firm’s fairness incentive plan. The Firm granted an mixture of 700,000 Choices and an mixture of 550,000 RSUs to sure staff and consultants of the Firm. Every Choice is exercisable at a worth of $0.05 per Frequent Share, expires three years from the date of grant and vested instantly. Every Choice is exercisable to buy one Frequent Share. Every RSU granted vested instantly.

Commercial 3

Article content material

All the Choices and RSUs (and any Frequent Shares issuable upon their train and settlement) are topic to a 4 month and at some point maintain interval pursuant to the insurance policies of the CSE and relevant securities legal guidelines.

Debt Settlements

Additional to its press launch dated December 22, 2023 (the “December 22 Launch”), the Firm has accomplished debt settlements within the quantity of $756,000 with every of 2388765 Ontario Inc., an organization managed by Igal Sudman (“238 Ontario”) and 1000677847 Ontario Inc., an organization managed by Roman Buzaker (“1000 Ontario”) to protect the Firm’s money by means of the issuance of 30,240,000 Frequent Shares, at a deemed worth of $0.05 per Frequent Share (every, a “Debt Settlement”).

Capitalized phrases not in any other case outlined herein have the meanings attributed to them within the December 22 Launch.

The Frequent Shares are topic to a 4 month and at some point maintain interval pursuant to the insurance policies of the CSE and relevant securities legal guidelines. Pursuant to the insurance policies of the CSE, completion of the Debt Settlements was topic to prior approval from the disinterested Shareholders and on the Assembly the Firm obtained the requisite disinterested Shareholder approval.

Article content material

Commercial 4

Article content material

Associated Social gathering Transaction

Every Debt Settlement constituted a “associated social gathering transaction”, as such time period is outlined in MI 61-101 because of the involvement of every of Messrs. Sudman and Buzaker (collectively, the “Officers”), who’re every administrators and officers of the Firm and direct and management, 238 Ontario and 1000 Ontario, respectively, and would have required the Firm to obtain minority shareholder approval for, and acquire a proper valuation for the subject material of, the transaction in accordance with MI 61-101, previous to the completion of such transaction. Nonetheless, in finishing the Debt Settlements, the Firm relied on exemptions from: (x) the formal valuation necessities of MI 61-101, on the premise that the Firm shouldn’t be listed on Specified Markets (as outlined in MI 61-101), as decided in accordance with MI 61-101; and (y) the minority shareholder approval necessities of MI 61-101, on the premise that the truthful market worth of every Officer’s participation of their respective Debt Settlement doesn’t exceed $2,500,000, as decided in accordance with MI 61-101.

Commercial 5

Article content material

Additional particulars will likely be included in a fabric change report back to be filed by the Firm. Whereas the Firm filed a fabric change report in respect of the Debt Settlements and the Officers’ participation within the Debt Settlements on January 2, 2024, the Firm didn’t file the fabric change report greater than 21 days earlier than the time limit of the Debt Settlements. Within the Firm’s view, the shorter interval was obligatory to allow the Firm to shut the Debt Settlements in a timeframe in keeping with common market observe for a transaction of this nature and was cheap and obligatory to enhance the Firm’s monetary place in a well timed method within the circumstances. Additional, the Officers indicated a want to finish the Debt Settlements on an expedited foundation.

Early Warning Disclosures

Efficient January 5, 2024, the Firm settled debt owing to 238 Ontario and 1000 Ontario within the mixture quantity of $1,512,000 ( a “Transaction”). As a part of the Transactions, 238 Ontario and 1000 Ontario every transformed $756,000 of their respective debt owed by the Firm into 15,120,000 Frequent Shares, at a deemed worth of $0.05 per Frequent Share. The Frequent Shares issued in reference to every Transaction are topic to a statutory maintain interval of 4 months and a day from the date of issuance.

Commercial 6

Article content material

Previous to the closing of the Transactions, 238 Ontario, along with its joint actor, Igal Sudman, beneficially owned an mixture of 29,305,424 Frequent Shares (of which 15,373,322 Frequent Shares had been owned by 238 Ontario immediately and 13,932,102 Frequent Shares had been owned by Igal Sudman), representing roughly 18.06% of the entire issued and excellent Frequent Shares on a non-diluted and partially diluted foundation. 1000 Ontario, along with its joint actors, Roman Buzaker and IIPAC Inc., an organization managed by Roman Buzaker (“IIPAC”), beneficially owned an mixture of 29,013,142 Frequent Shares (of which Nil Frequent Shares had been owned by 1000 Ontario immediately, 15,373,322 Frequent Shares had been owned by IIPAC, and 13,639,820 Frequent Shares had been owned by Roman Buzaker), representing roughly 17.88% of the entire issued and excellent Frequent Shares on a non-diluted and partially diluted foundation.

Following the completion of the Transaction, 238 Ontario, along with its joint actor, now has possession and management over an mixture of 44,425,424 Frequent Shares (of which 30,493,322 Frequent Shares are owned by 238 Ontario immediately and 13,932,102 Frequent Shares are owned by Igal Sudman), representing roughly 23.08% of the entire issued and excellent Frequent Shares on a non-diluted and partially diluted foundation. 1000 Ontario, along with its joint actors, Roman Buzaker and IIPAC, now has possession and management over an mixture of 44,133,142 Frequent Shares (of which 15,120,000 Frequent Shares are owned by 1000 Ontario immediately, 15,373,322 Frequent Shares are owned by IIPAC, and 13,639,820 Frequent Shares are owned by Roman Buzaker), representing roughly 22.93% of the entire issued and excellent Frequent Shares on a non-diluted and partially diluted foundation.

Commercial 7

Article content material

238 Ontario, along with its joint actor, Mr. Sudman, and IIPAC, along with its joint actor, Mr. Buzaker, every most just lately filed an early warning report pursuant to Nationwide Instrument 62-104 – Take-Over Bids and Issuer Bids on October 18, 2022 (collectively, the “Prior EWRs”). Since then, the Firm has issued Frequent Shares in quite a lot of transactions, which has resulted in every of 238 Ontario’s, along with its joint actor, Igal Sudman, and 1000 Ontario’s, along with its joint actors, IIPAC and Roman Buzaker, holdings to extend by greater than 2%. As on the date of the Prior EWRs, (i) 238 Ontario, along with its joint actor, Igal Sudman, beneficially owned an mixture of 26,895,424 Frequent Shares, representing roughly 17.43% of the entire issued and excellent Frequent Shares on a non-diluted and partially diluted foundation and (ii) 1000 Ontario, along with its joint actors, Roman Buzaker and IIPAC, beneficially owned an mixture of 26,603,142 Frequent, representing roughly 17.24% of the entire issued and excellent Frequent Shares on a non-diluted and partially diluted foundation.

Commercial 8

Article content material

The Frequent Shares acquired pursuant to the Transactions had been acquired by every of 238 Ontario and 1000 Ontario for funding functions, and relying on market and different circumstances, every of 238 Ontario and 1000 Ontario, might every now and then sooner or later improve or lower their respective possession, management or route over securities of the Firm by means of market transactions, personal agreements, or in any other case.

An early warning report pursuant to the necessities of relevant securities legal guidelines will likely be issued by every of 238 Ontario and 1000 Ontario, individually, and will likely be posted to SEDAR+ at